Home Office Deduction 2024 Self Employed Tax – The home office tax deduction is an often overlooked tax break for the self-employed that covers expenses for the business use of your home, including mortgage interest, rent, insurance . You must have some Schedule C income from self-employment to be eligible for the home office deduction. Does Your Home Office Qualify for the Tax Break? Your home office must meet certain .

Home Office Deduction 2024 Self Employed Tax

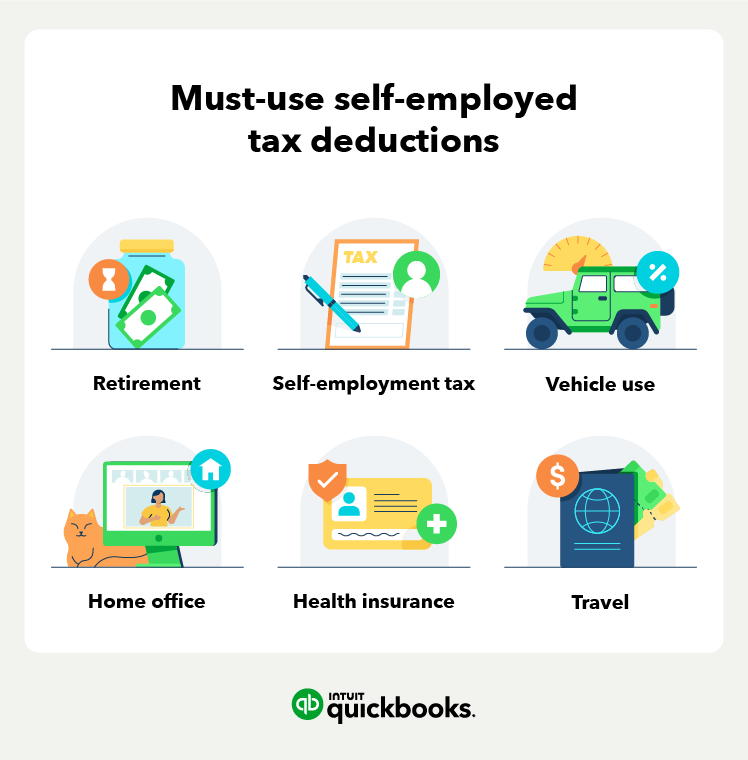

Source : turbotax.intuit.com2024 Tax Write Offs for Self Employed Loan Brokers ARF Financial

Source : www.arffinancial.comtaxtonecpa is one of the best CPAs in the game and is finally

Source : www.instagram.com17 self employed tax deductions to lower your tax bill in 2023

Source : quickbooks.intuit.comHow Working from Home Affects Income Taxes & Deductions (2023 2024)

Source : www.debt.orgThe Joe Soto Team | Cypress CA

Source : www.facebook.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comABSE TAX : Accounting and Business Services | Artesia CA

Source : www.facebook.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comJohn W Royston, EA & Associates | Broussard LA

Source : m.facebook.comHome Office Deduction 2024 Self Employed Tax The Home Office Deduction TurboTax Tax Tips & Videos: But can the remote work setup also include tax re employed. Traditional employees earning W-2 income generally are not eligible for the home office deduction, while those who are self-employed . You can’t claim the home office deduction or self-employed worker. To qualify, you must use your home office regularly and exclusively for work, and there are two ways to calculate the tax .

]]>