New 1099 Rules 2024 Example – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . The proposed regulation would require the reporting of information about non-financed residential real estate sales to legal entities, trusts, and shell companies. .

New 1099 Rules 2024 Example

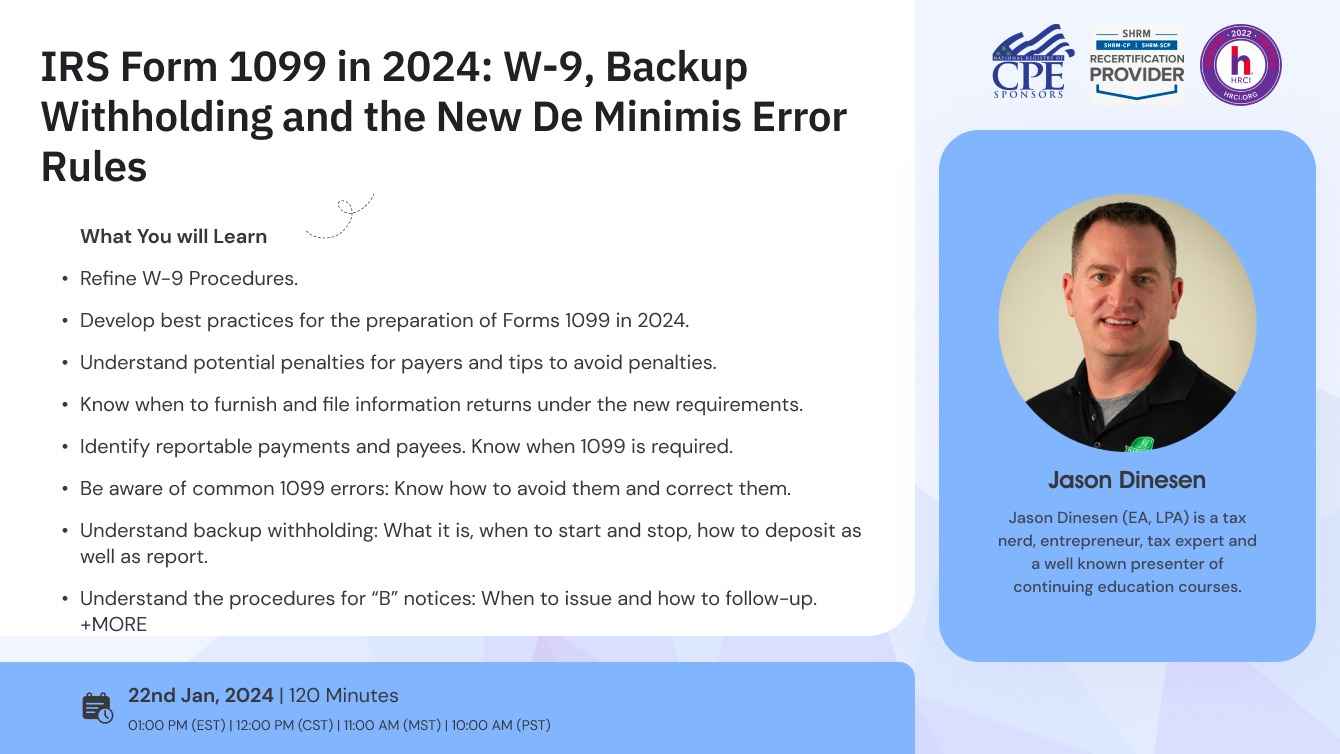

Source : tipalti.comIRS Form 1099 in 2024: W 9, Backup Withholding and the New De

Source : clatid.io1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.comSmall business 1099: Complete guide for 2024 | QuickBooks

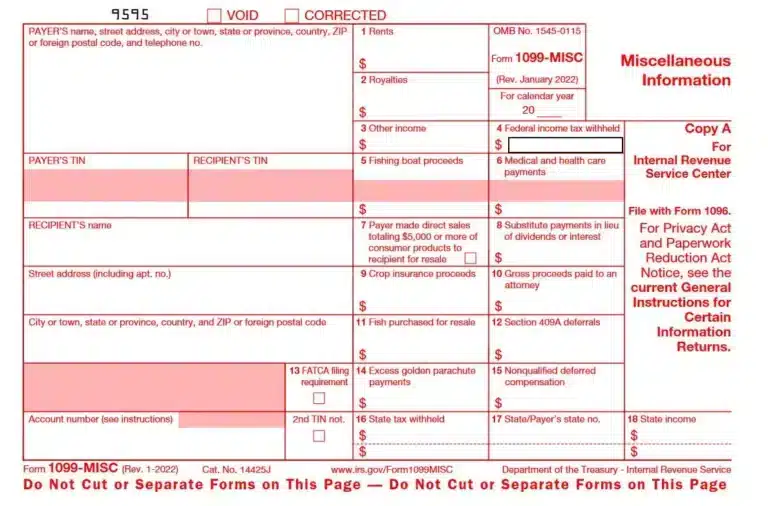

Source : quickbooks.intuit.comSmall businesses: Get ready for your 1099 MISC reporting

Source : hwco.cpa1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.com1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.com1099 K Reporting Requirement Delayed for 2023; New, Phased In

Source : www.pbmares.comIRS delays 1099 K rules for side hustles, ticket resales

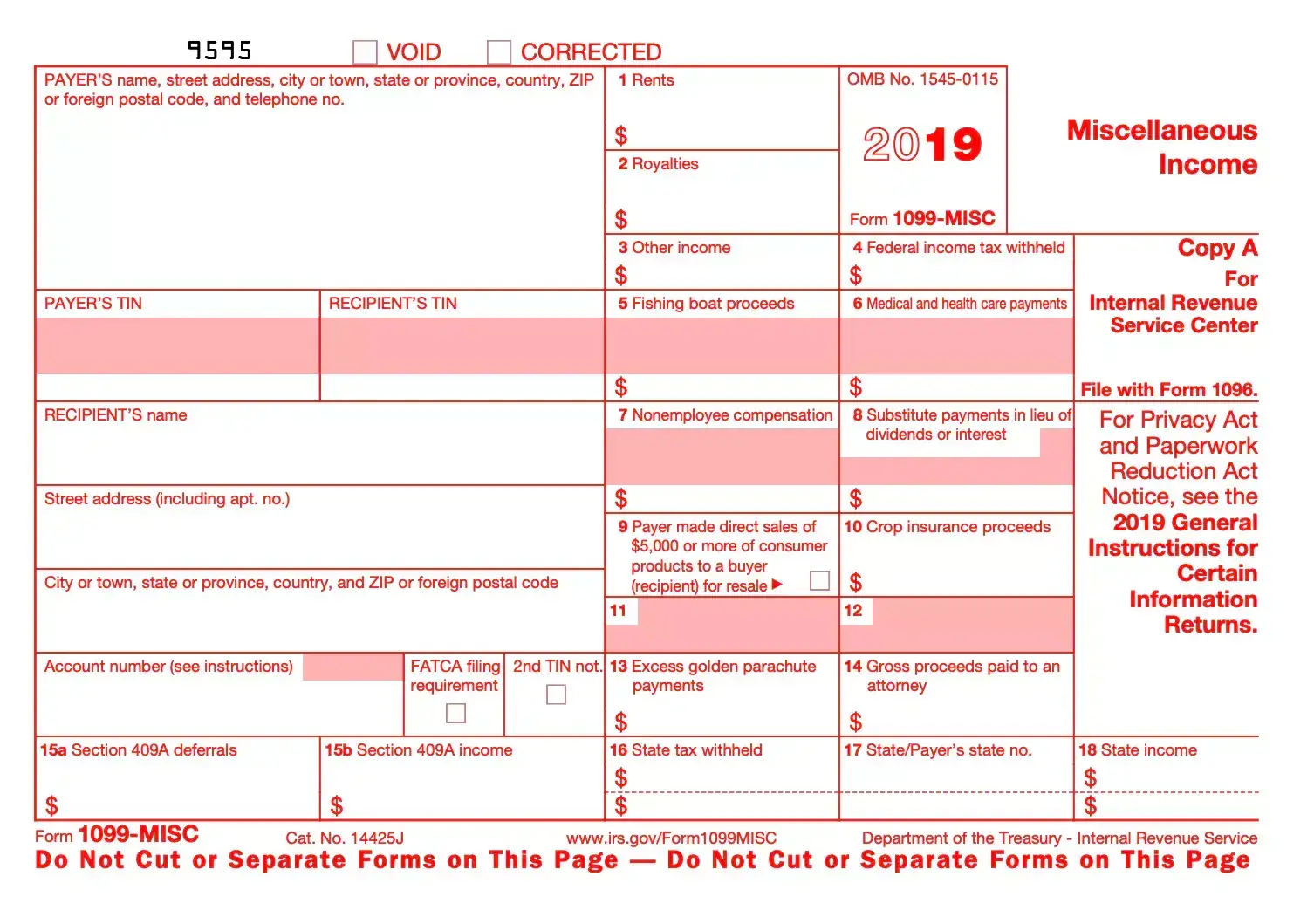

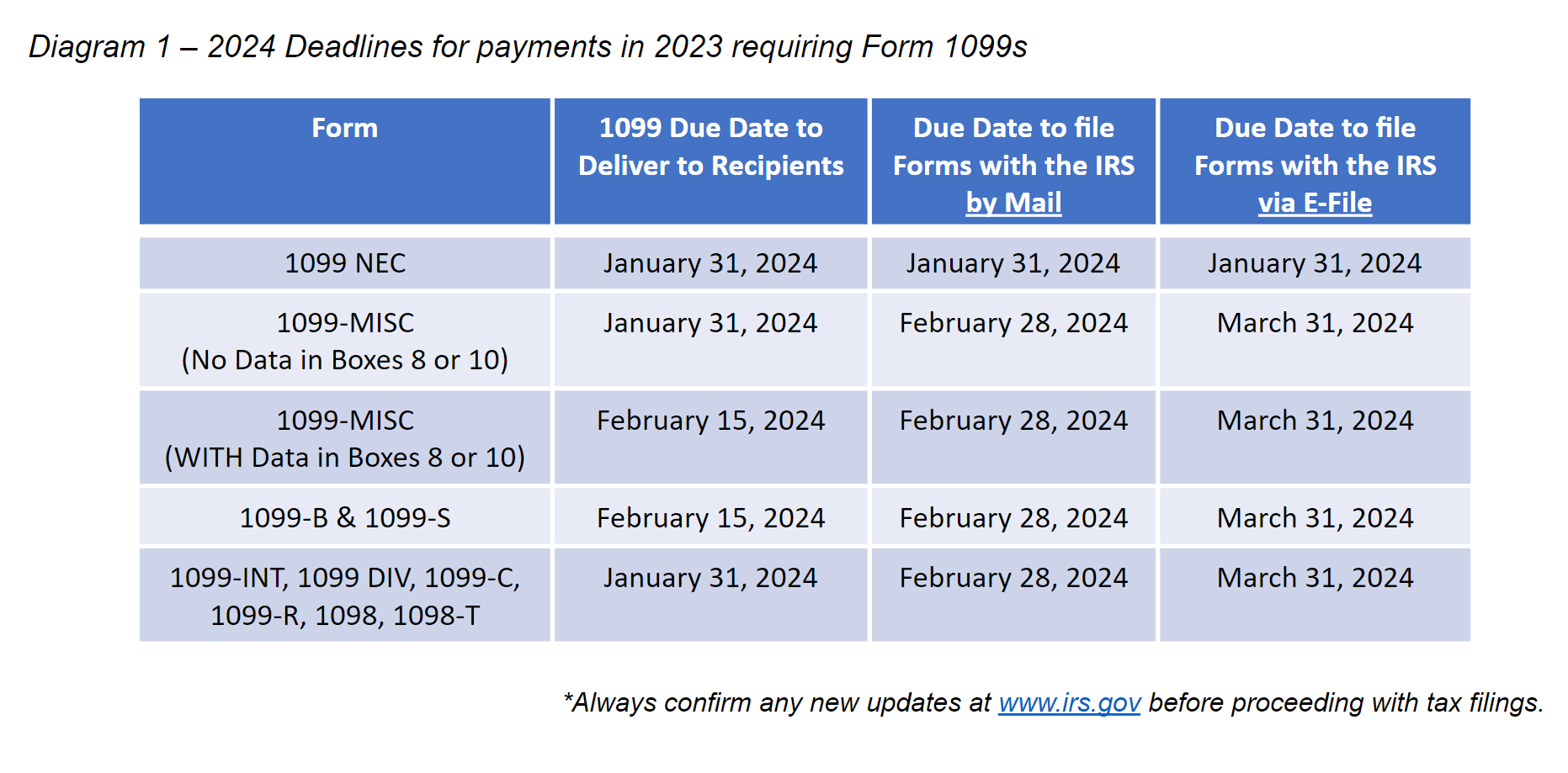

Source : www.usatoday.comNew 1099 Rules 2024 Example Form 1099 MISC Explained: Instructions and Uses: Tax season is in full swing. If you’re waiting on a 1099-K to file your tax return — you may not be getting one. Since the IRS has delayed launching its new 1099-K reporting requirement, . Ready or not, the 2024 Form 1099-K reporting to $600 or more. This change was to take effect this tax season. But feedback from taxpayers and payment processors confused by the new rules .

]]>